Now there is no getting away from the absolute panic that has been thrust across markets, both property and financial! I have had many an encouraging phone call this week, with the majority of buyers and sellers not changing plans and been relatively accepting that this is one mighty ‘blip/reaction’ and that if given a couple of months - things will settle. The media is doing nothing to calm and educate, instead making sweeping statements about 10% interest levels and 31% house price crashes - it’s enough to keep anybody locked inside.

Let’s get things straight, there is always a market - be it, good, bad or indifferent. Todays market has absolutely been affected by recent events - prices quoted 3 and 6 months ago, are not being achieved today, will they recover to those levels - sure, overtime. Should that stop you moving, absolutely not - remember, if you’re buying and selling - it’s relative.

Now, the one spanner that’s been thrown into the works - mortgages - products being pulled and interest rate hikes to protect funds during this period of unsettlement. Todays rates might well mean that if you’ve been looking for a while and not committed, you may now face not being able to achieve the level of borrowing that you’d previously thought possible.

Everything has to be considered and I’m really lucky to have a cracking team around me that is here to help you. The Solihull ‘micro-climate’ really is one on its own and whilst buyers are price sensitive they do remain active.

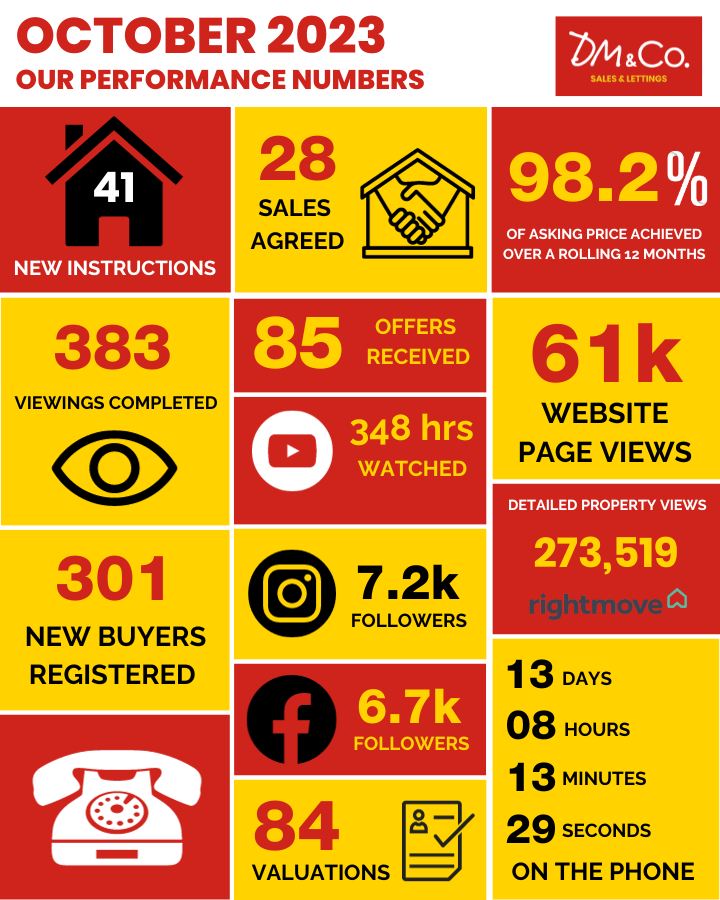

September on the sale front has seen 594 buyers register, 115 valuations carried out, 47 new instructions, 517 viewings, 99 offers and 51 sales agreed.

I promise, if your property isn’t attracting buyers today it’s 90% likely to be a matter of pricing - in normal circumstances I’m the first to defend the converstion of a price reduction.

On a personal note, I was pleased to finally get my mortgage offer through last week, I was called into the solicitors on Monday and signed papers…we were meant to exchange and haven’t yet, as annoying as that is I’m wholly committed to my purchase.

Right, enough from me - but please do call if you’d like to discuss anything property related. I’m going to leave you now with a roundup from Lisa Smith my Sales Director.

Well, it’s been an interesting week, and if only I had a crystal ball and the answers to all the questions I have been asked! There is no doubt that there is uncertainty surrounding the housing market and how it will perform over the coming months. However, there is certainty that there will be homeowners who need to move for a variety of reasons, and they will be asking for advice on how best to do this and when is the best time to do so. Do you sell and buy now, or wait to see what happens, or is that risky? It is not all doom and gloom, we have new properties coming to market, sales are being agreed, and buyers are calling to arrange viewings. So, call the office for a chat, follow us on social media, and if you are thinking of selling, I will provide honest advice. Choosing the right agent has never been so important, and after taking a call from someone disillusioned with their current agent yesterday, it confirms what I already know –‘not all agents are the same’! - Lisa Smith, Sales Director

Over the course of the last week with recent media updates we have been asked questions concerning whether now is a good time to buy a property or not, especially with the rising cost of living and interest rates. My suggestion is to think that if are looking to buy your first home, upsize or even relocate why put your life on hold? The most important thing is to make sure your monthly payments are affordable and if they are then why not come and buy your dream home; after another busy week of instructions we have a good choice available! Who knows what the future holds but rarely is a house ever a bad investment; if it’s a long term family home then why wait? Please feel free to call if you are looking to buy or sell, or just like an informal chat about the property market we will be only too happy to assist you. - Victoria Stuart - Sales Negotiator in the Solihull Team

The surge in the lettings market continues and the proof is in the pudding. September saw us manage 244 tenants looking for a home, 23 valuations, 14 instructions, 65 viewings and 13 move ins! We like to market our properties with a competitive rental price & even still we are experiencing prospective tenants offering over & above to try & secure a new home. This is now becoming a more regular negotiation of tying up a deal & only goes to prove that the supply to demand is off balance. Interestingly, our most common price budget sits between the £1200- £2500 pcm and I will say it again, we need to feed the demand, the rental market is booming & those people with a bit of cash burning a hole in their pockets can spend it on bricks & mortar! I’m here offering FREE advice on where the hotspot areas to buy your next or new investment are - Join The Landlord Club today…by clicking here - Gabrielle Argue, Head of Lettings

Well despite all the doom and gloom painted by the media we have had a fantastic month agreeing sales on 7 fabulous properties with an average price of £1,350,000 with two more agreed ready to process next week! With one low profile launch fully booked today, we are certainly at the higher end of the market seeing lots of positive activity. I do feel that if the media didn’t paint such a dismal picture, the market in general, would be a far healthier place - but there isn’t much we can do about that! If you are looking to sell your family home, honestly don’t hold back there are plenty of good buyers out there looking for their forever home. - Kathy Griffiths, Head of Premium

Thank you for taking the time to read this weeks market update - if you would like to know about anything property related, we would love to hear from, and help you. If you’d like to book a valuation, that is really easily done - click here!

Let’s be honest - selling your home is never going to be easy, there will always be something that doesn’t quite go to plan - what is incredibly important is how your agent reacts to these instances.

If you would like to learn more about how we operate, please get in touch with the Solihull or Dorridge office on 0121 775 0101 or 01564 777 314 respectively.

We look forward to hearing from you.

Kind regards,

Dominic Murphy

Managing Director – DM & Co. Homes

WhatsApp me on 07595 903 811

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link